The Insurance Industry has been in the news lately. But, honestly, when are they ever not in the news? Sadly, the CEO of one of the largest in the Industry was recently killed in an ambushed-style shooting. Our thoughts and prayers go out to his family and loved ones.

Does it have to take such an incident though for America to wake up to realize that something is extremely wrong with the Insurance Industry? I sincerely hope that the Industry will undergo some reform soonest. But,

You don’t know how good you have it if you have an employer-paid healthcare coverage. Even at that, those benefits have been on the decline with premiums and out-of-pocket expenses skyrocketing every year.

while insurance safeguards against financial ruin, the cost of obtaining and maintaining comprehensive coverage can be financially overwhelming.

Why an Insurance?

Insurance is designed to provide financial protection and peace of mind, but for the average American, it often feels like a double-edged sword. To maintain a comfortable lifestyle, Americans are expected to carry several types of insurance, each with its own set of benefits and burdens. This creates a paradox: while insurance safeguards against financial ruin, the cost of obtaining and maintaining comprehensive coverage can be financially overwhelming.

There is also the penalty imposed should you fail to have these protections in place.

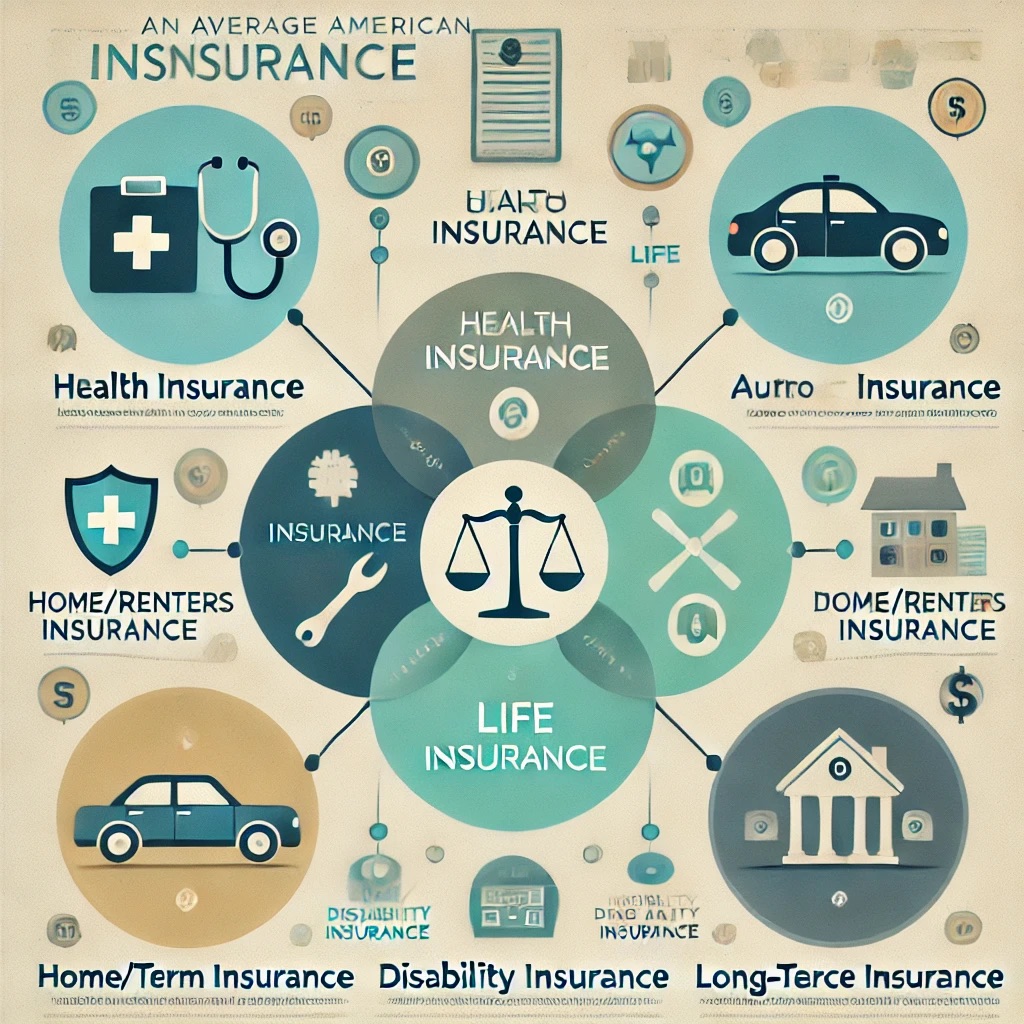

What types of insurances must the average American have?

Types of Insurance

While a few are mandatory for all, others are optional. The different types range from health to life insurance. Below is a breakdown of the key insurance types most Americans need:

1. Health Insurance

• Pros: Covers medical expenses, preventive care, and major health emergencies. Essential for managing high healthcare costs in the U.S.

• Cons: Premiums, deductibles, and co-pays can be prohibitively expensive. Limited provider networks often restrict choice.

• Paradox: Not having health insurance can lead to crippling debt if medical emergencies arise. Yet, even those with health insurance may struggle to afford care due to high out-of-pocket costs.

2. Auto Insurance

• Pros: Protects against accidents, theft, and liability. Legally required in most states to operate a vehicle.

• Cons: Premiums can increase drastically due to accidents or traffic violations, even if you’re not at fault.

• Paradox: A person may go years without filing a claim but is still required to pay premiums. The financial loss of skipping coverage far outweighs the savings if an accident occurs.

3. Homeowners/Renters Insurance

• Pros: Provides coverage for property damage, theft, and liability. Often required by mortgage lenders or landlords.

• Cons: Policies may exclude natural disasters, requiring additional coverage. Premiums are often tied to property location and value.

• Paradox: Paying for protection you might never use, but without it, a single disaster could leave you homeless or bankrupt.

4. Life Insurance

• Pros: Offers financial security to dependents after the policyholder’s death. Some policies have investment components.

• Cons: Premiums can be high, especially for whole-life policies. Term policies expire with no payout unless the policyholder dies during the term.

• Paradox: You’re essentially paying for peace of mind for others, knowing you’ll never directly benefit from the policy.

5. Disability Insurance

• Pros: Replaces income if you’re unable to work due to illness or injury. Critical for maintaining financial stability.

• Cons: High premiums and restrictive definitions of “disability” can make it difficult to qualify for benefits.

• Paradox: Many overlook this insurance, thinking it’s unnecessary, only to face devastating consequences if they become unable to work.

6. Long-Term Care Insurance

• Pros: Covers costs of assisted living, nursing homes, and in-home care, which Medicare often doesn’t.

• Cons: Extremely expensive premiums, with no guarantee of use. Coverage might not fully match future care needs.

• Paradox: Many skip this insurance, gambling they won’t need it, but long-term care expenses can drain life savings quickly.

The Pros of Having Insurance

1. Financial Protection: Insurance prevents unexpected events from turning into financial catastrophes.

2. Peace of Mind: Knowing you’re covered allows you to focus on other aspects of life.

3. Legal Compliance: Auto and health insurance are mandatory in many states.

4. Support for Loved Ones: Life and disability insurance ensure your family is taken care of if something happens to you.

The Cons of Having Insurance

1. High Costs: Premiums, deductibles, and out-of-pocket expenses can consume a significant portion of income.

2. Unnecessary Coverage: Policies may include features you don’t need or use, leading to wasted money.

3. Denials and Disputes: Insurers may deny claims, leaving you to fight for coverage in stressful situations.

4. Economic Inequality: Those with lower incomes often can’t afford adequate insurance, leaving them vulnerable.

The Paradoxes of Insurance

1. Paying for Uncertainty: You’re spending money on something you hope never to use. If you never file a claim, it can feel like a waste, yet not having coverage is too risky.

2. The Coverage Gap: Despite being insured, many Americans still face financial struggles due to high deductibles or uncovered situations, undermining the very purpose of insurance.

3. Affordability vs. Necessity: The very people who need insurance the most; that is, those with lower incomes, are often unable to afford it, perpetuating cycles of poverty and instability.

4. Overlapping Coverage: Some insurances overlap, such as health insurance covering certain disabilities and auto insurance covering medical bills. This redundancy feels inefficient but necessary.

5. The Endless Cost Cycle: Premiums rise even if claims aren’t made, often without clear justification, leaving people paying more for less coverage over time.

Conclusion: Navigating the Insurance Paradox

For the average American, insurance is both a lifeline and a burden. The key to managing this paradox is careful planning:

• Prioritize Coverage: Focus on essential policies that protect against the most significant risks.

• Shop Around: Compare providers to find the best value for your needs.

• Reassess Regularly: As your life circumstances change, your insurance needs will too.

• Build Emergency Savings: A safety net can help offset the gaps in your coverage.

Ultimately, the paradox of insurance is one of balance—paying for protection today to avoid devastation tomorrow, all while managing the financial strain it places on your present.

Do you have all these insurances in place? Why or why not?

Pingback: Part 2: The Paradox of Insurance - Think-Talk