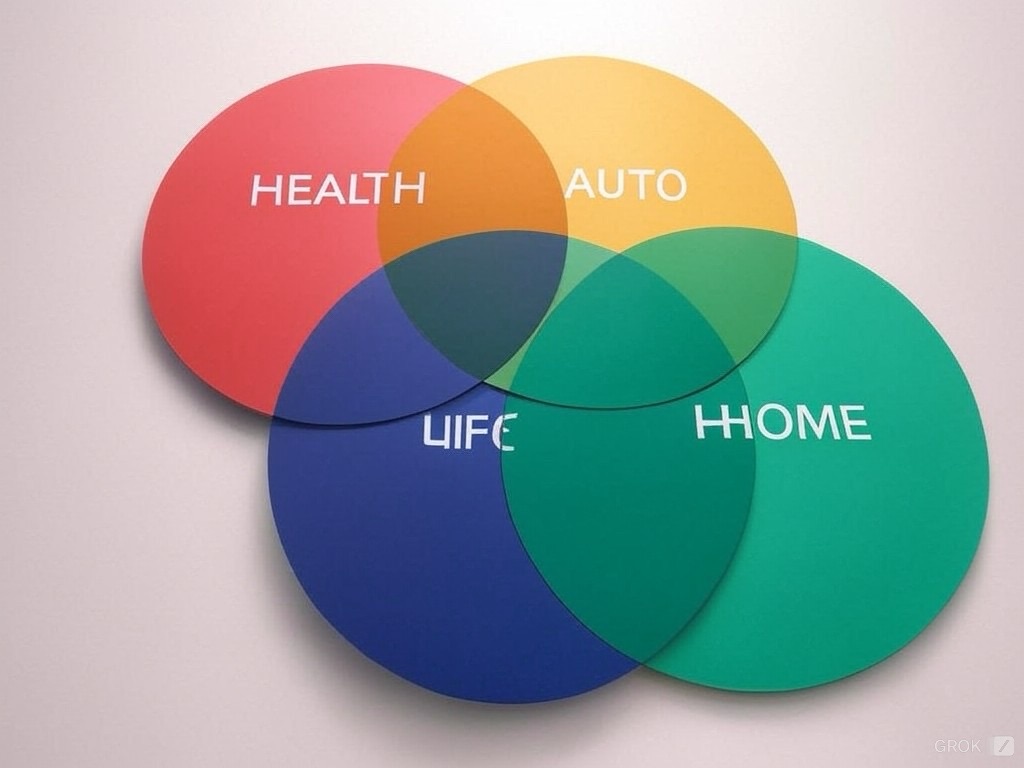

Here’s a concise overview of Part 1 of this article listing the essential insurance types for comfortable living in the U.S.:

1. Health Insurance is essential to cover medical expenses, which can be exorbitantly high without insurance. Types of health insurance are private (through employers or the marketplace), Medicare (for those 65+), Medicaid (for low-income families), and short-term plans for gaps in coverage.

2. Auto Insurance is legally required in most states and protects against financial loss in case of accidents or theft. The types include Liability (covers damage/injury to others), collision (damage to your car), comprehensive (non-collision events like theft), and uninsured/underinsured motorist coverage.

3. Homeowners or Renters Insurance protects your home and belongings from damage or theft; also provides liability coverage.

The Renters Insurance is similar to homeowners but for renters, covering personal property and liability.

These insurances are essential for financial protection against disasters, theft, or lawsuits.

4. Life Insurance provides financial support to dependents after the policyholder’s death. It’s either a Term life (coverage for a specific period) or a whole life (permanent coverage with a cash value component).

5. Disability Insurance replaces part of your income if you’re unable to work due to illness or injury. You can have either a short-term which covers temporary disability or a long-term disability insurance.

6. Long-Term Care Insurance covers costs for extended care due to chronic illness, disability, or aging. The types are traditional policies and hybrid life insurance policies with long-term care riders.

Remember, insurance is about managing risk, not eliminating it, so choose wisely based on your personal circumstances.

This post provides a few additional insights to consider when navigating the paradox of Insurance:

Insights To Consider When Navigating The Paradox of Insurance

1. Self-Insurance and Risk Management

While traditional insurance is necessary for most, building an emergency fund can act as a form of “self-insurance.” By saving 3-6 months of living expenses, you can cover smaller emergencies or offset costs like high deductibles, reducing reliance on insurance claims. This approach works well for risks that aren’t catastrophic but are frequent, such as minor home repairs or dental work.

2. Preventive Measures Can Lower Costs

Many insurance policies reward preventive behaviors:

• Health insurance: Annual check-ups, fitness programs, and healthy habits may reduce premiums or offer incentives.

• Auto insurance: A clean driving record, installing safety features, or opting for usage-based insurance can lead to discounts.

• Home insurance: Adding security systems, fire alarms, and floodproofing can lower premiums.

By taking proactive steps to mitigate risks, you reduce the likelihood of needing to file claims and can often secure better rates.

3. The Hidden Costs of Being Underinsured

Choosing the cheapest policy can seem like a smart decision, but being underinsured can lead to major financial burdens:

Inadequate liability coverage in auto insurance might leave you personally responsible for damages exceeding policy limits.

Insufficient health insurance might force you to delay care, leading to more severe (and costly) health issues later.

While it’s tempting to cut corners, it’s critical to ensure your coverage adequately protects you against significant risks.

4. Consider Bundling Policies

Many insurers offer discounts for bundling policies (e.g., combining auto and home insurance). While this can save money, always compare the bundled price to standalone policies from different providers to ensure you’re getting the best deal.

5. Understand Policy Exclusions

A major frustration arises when claims are denied due to fine print or exclusions in the policy. Before signing, carefully review what’s covered—and what isn’t. For instance:

Health insurance may exclude alternative treatments or out-of-network care.

Home insurance often excludes floods or earthquakes, requiring separate coverage.

Knowing these details in advance can prevent costly surprises.

6. Leverage Tax Benefits

Certain types of insurance offer tax advantages:

Health Savings Accounts (HSAs): Paired with high-deductible health plans, HSAs allow you to save pre-tax dollars for medical expenses.

Life insurance: Payouts are generally tax-free for beneficiaries, and some policies (like whole-life) grow tax-deferred.

Maximizing these benefits can help offset the high cost of insurance premiums.

7. The Role of Employer-Sponsored Insurance

Many Americans access health, life, and disability insurance through their employers, often at a lower cost. However, many employer plans may not meet all your needs (e.g., insufficient life insurance coverage).

Losing your job often means losing coverage, highlighting the importance of having personal policies as a backup.

8. The Rise of “InsureTech”

New technology-driven insurance companies (like Lemonade or Root) are shaking up the industry with lower costs, simplified claims processes, and user-friendly apps. These companies often appeal to younger consumers but may lack the comprehensive coverage offered by traditional insurers. If considering these options, research their reputation and financial stability.

9. Community Insurance Alternatives

For some, alternatives like healthcare sharing ministries or cooperative insurance groups may be appealing. These models pool resources among members to cover expenses, often at a lower cost. However, they aren’t regulated like traditional insurance, so benefits and protections may vary significantly.

Financial Education Is Key

Many people purchase insurance without fully understanding their policies or coverage options. Taking the time to educate yourself on terms like deductibles, premiums, and policy limits can empower you to make better decisions. Seek advice from a trusted financial advisor or insurance broker when in doubt.

By keeping these additional tips in mind, readers can better navigate the complexities of insurance, ensuring they strike the right balance between financial security and affordability.

What if you’re unemployed, and can’t afford coverage?

There are still ways to secure some level of health protection. Here are a few practical steps and advice to consider:

1. Explore Government-Sponsored Programs

Medicaid: Designed for low-income individuals and families, Medicaid provides free or low-cost health insurance. Eligibility is based on income and household size, and rules vary by state.

Children’s Health Insurance Program (CHIP): If you have children, CHIP offers affordable health coverage for kids, even if you don’t qualify for Medicaid.

Affordable Care Act (ACA) Marketplace Plans: Visit HealthCare.gov or your state’s health insurance marketplace to explore subsidized insurance plans. Premium tax credits and cost-sharing reductions may lower your monthly payments or out-of-pocket costs. Lately, the premiums on these have also skyrocketed making it unaffordable for many.

2. Consider Short-Term Health Insurance

Short-term health insurance plans provide temporary coverage for emergencies or major illnesses. They are typically cheaper than full insurance plans. But may have limited benefits (e.g., no coverage for pre-existing conditions or preventive care). These plans work best as a stopgap while seeking a more permanent solution.

3. Look for Community Health Resources

Federally Qualified Health Centers (FQHCs): These clinics offer free or low-cost healthcare services based on your ability to pay.

Community Health Clinics: Many nonprofit clinics provide care for little to no cost, including routine check-ups, vaccinations, and urgent care.

4. Negotiate Medical Costs

If you’re uninsured, you may be able to negotiate the cost of medical services.

• Ask hospitals or providers for self-pay discounts.

• Inquire about charity care programs or payment plans.

• Use tools like GoodRx to find lower prices on prescriptions.

5. Join a Healthcare Sharing Ministry

Healthcare sharing ministries are faith-based organizations where members pool funds to cover medical expenses. While not insurance, these programs often have lower costs but limited coverage and strict eligibility requirements. Examples include Medi-Share or Samaritan Ministries.

6. Leverage Low-Cost Preventive Care Options

Retail Clinics: Walk-in clinics at pharmacies (e.g., CVS MinuteClinic or Walmart Care Clinic) offer affordable basic care.

Telehealth Services: Platforms like Teladoc or Amwell provide virtual consultations at lower costs.

Take advantage of free health screenings or vaccination drives in your area.

7. Side Hustles with Benefits

Some part-time jobs and gig platforms offer limited health insurance to workers:

Starbucks, Amazon, or Costco: These companies provide benefits to part-time employees.

Gig Work: Companies like Uber, Lyft, Freelancers, etc. may offer access to discounted health plans. But the premiums are usually higher than those of the Affordable Care plans and they don’t offer much plan options.

8. Seek Help from Nonprofits

Organizations like The Patient Advocate Foundation or NeedyMeds assist individuals in accessing affordable healthcare or medications.

Local charities may provide funds or resources for specific healthcare needs.

9. Emergency-Only Coverage

If full coverage isn’t an option, focus on protecting yourself against catastrophic costs.

Consider a catastrophic health plan (available for those under 30 or with a hardship exemption). These plans have low premiums but high deductibles, covering only major medical events.

10. Build an Emergency Fund

While challenging without stable income, setting aside even small amounts can help cover minor health expenses, reducing your reliance on credit or loans during emergencies.

11. Mental Health and Wellness Options

Many communities offer free or low-cost mental health services. Apps like Calm and Headspace also provide affordable resources for mental wellness.

12. Apply for a Hardship Exemption

If you can’t afford health insurance, you might qualify for a hardship exemption under the ACA. This could allow you to enroll in a catastrophic plan or avoid penalties for being uninsured.

13. Long-Term Strategies

Focus on improving your overall health through diet, exercise, and preventive care to reduce the likelihood of needing expensive medical treatment.

Explore free or low-cost training programs to secure jobs with benefits. Including networking for opportunities in industries known for providing healthcare coverage to part-time workers.

By using these strategies, you can navigate the challenges of being uninsured while protecting your health and financial stability as much as possible.

If the above options feel out of reach, there are additional tailored suggestions such as:

1. Focus on Free or Sliding-Scale Health Resources

Sliding-Scale Clinics: Community health centers (often federally funded) adjust their fees based on your income. You can often get basic services like check-ups, immunizations, and prescriptions for minimal cost.

Hospital Charity Programs: Many hospitals offer free or discounted care for uninsured patients. Always ask about financial assistance programs when seeking care.

Local Health Fairs: Keep an eye out for free health fairs offering services like screenings, dental cleanings, and wellness checks.

2. Access Preventive Care Through Nonprofits

Organizations like Remote Area Medical (RAM) provide free or affordable care, including women’s health services, dental care, and general medical consultations.

3. Low-Cost Medication Programs

$4 Generics at Retail Pharmacies: Stores like Walmart and Kroger offer essential medications at low prices. However, you will still need a prescription to obtain them.

Patient Assistance Programs: Many pharmaceutical companies provide free or deeply discounted medications for those who qualify.

Discount Cards: Programs like GoodRx or SingleCare can help you find the lowest price for medications in your area.

4. Rethink Catastrophic Coverage

While comprehensive plans are expensive, catastrophic insurance might still provide a safety net for major emergencies, preventing financial ruin.

You can apply for special enrollment exemptions to qualify for these plans if regular premiums are unaffordable. These plans usually cover essential health benefits after a high deductible is met.

5. Use Telehealth for Routine Care

Telehealth services can be much cheaper than in-person visits and are suitable for minor illnesses, mental health care, and prescription renewals. Platforms like SesameCare, PlushCare, or Teladoc Health offer pay-per-visit options starting as low as $20.

6. Utilize State or Local Resources

Some states and counties offer limited health programs specifically for uninsured individuals. These can include:

• Low-cost insurance alternatives.

• Coverage for specific groups, such as women, children, or low-income residents.

Research your state’s health department for options beyond federal programs.

7. Preventative Lifestyle Adjustments

While not a substitute for insurance, prioritizing health through diet, exercise, and stress management can reduce the likelihood of costly medical issues. This is especially important for conditions like diabetes, hypertension, and heart disease.

8. Short-Term or Limited Benefit Plans

While not ideal for comprehensive care, these plans can offer some peace of mind for specific needs. For example:

Accident Insurance: Covers costs related to injuries.

Critical Illness Insurance: Helps cover expenses for major diagnoses like cancer or heart attacks.

9. Engage with Free Advocacy Services

Health advocates or social workers can help you navigate the system, apply for benefits, and negotiate bills. Organizations like Patient Advocate Foundation specialize in this.

A Tough Reality

For many Americans, even “affordable” solutions feel out of reach. This reality underscores the importance of continuing to advocate for systemic reforms to make healthcare more accessible and equitable. In the meantime, leveraging free or low-cost resources while focusing on preventive care and strategic risk management can help you get by without breaking the bank.

If you’re struggling, it’s also okay to lean on community support networks—whether friends, family, or local nonprofits. You’re not alone in facing these challenges.